Overview

In the dynamic landscape of Fintech, navigating risk management strategies and understanding regulatory considerations are crucial for any player.

Course Description & Learning Outcomes

This module offers a comprehensive exploration into the three cardinal components that This module allows participants to explore the crucial intersection between Fintech and risk management, with a focus on understanding the opportunities and challenges posed by Fintech innovations in various risk domains. They will be exposed to the technologies and strategies employed to mitigate risks and will gain insights into the importance of regulatory compliance and cybersecurity for Fintech companies. The course also focuses on the complexity of regulatory and legal aspects of Fintech. Participants will gain an in-depth understanding of the regulatory landscape and considerations specific to various Fintech sectors. The course will also address the unique legal challenges associated with Fintech innovations and will shed light on the international regulatory challenges and the ongoing efforts to harmonize regulations in the global Fintech ecosystem. This module is part of the Advanced Certificate in Fintech and the Future of Finance. LEARNING OBJECTIVES At the end of the 3-day module, participants will be able to: - Understand the intersection of Fintech with risk management in the financial industry, exploring both the opportunities and challenges it presents - Gain insights into the technologies and strategies employed in the Fintech industry to mitigate various forms of risks - Recognise the importance of regulatory compliance and cybersecurity in the Fintech industry and the measures employed to ensure them - Develop a comprehensive understanding of the regulatory landscape and the considerations specific to various Fintech sectors - Identify the legal challenges associated with Fintech innovations and understand how they are addressed - Discuss international regulatory challenges in the Fintech industry and the ongoing efforts to harmonise regulations in the global Fintech ecosystem

Recommended Prerequisites

- Participants should have a basic understanding of financial and economic concepts. - A basic understanding of technology, including familiarity with computer systems and software applications, is beneficial. - Knowledge of data analysis, programming, or software development, while not mandatory, could enhance the learning experience. - Some professional experience, particularly in roles related to finance, technology, entrepreneurship, or regulation, can enrich the participant's understanding of course content. - Motivated fresh graduates or students with a keen interest in Fintech are also welcome.-

Schedule

End Date: 12 Jun 2024, Wednesday

Location: Online

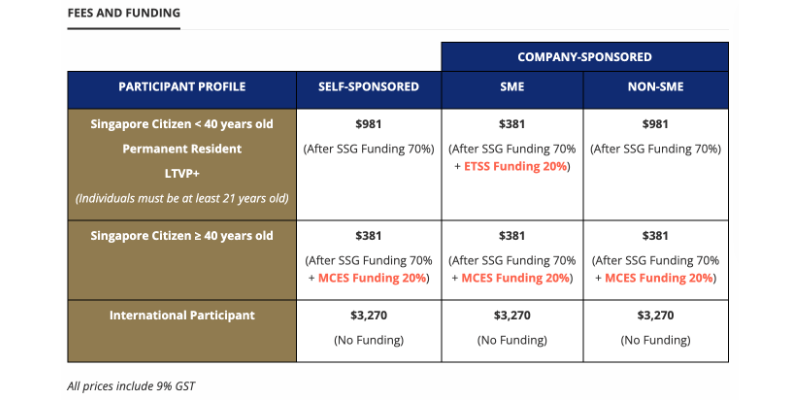

Pricing

Speakers

Trainer's Profile:

Ilan Gildin, SMU Affiliate Faculty, Singapore Management University

As the Chief Economist and Strategic Advisor to the Chairman of the Israel Securities Authority (ISA), Gildin heads the economic department, providing crucial economic and empirical support across a range of subjects, including the regulatory framework for digital assets. With his blend of practical experience, academic pursuits, and a keen focus on fintech and digital assets, Gildin provides invaluable perspective to the fintech program. His knowledge and dedication to innovation serve to equip participants with the tools, insights, and understanding required to navigate and thrive in the rapidly evolving world of fintech. Ilan is the main trainer for this module.

Trainer's Profile:

Dr. Shlomit Wagman, Chief Regulation and Compliance Officer , Rapyd

Dr. Shlomit Wagman is an expert in the fields of financial regulation, financial crimes and investigations, FinTech, RegTech, money laundering, terrorism financing, privacy and data protection, digital assets and crypto-currencies. Dr. Wagman is the former Director-General of the Israel Money Laundering and Terror Financing Prohibition Authority (IMPA), a financial regulator and law enforcement agency, and the former Acting Director-General of the Israel Privacy Protection Authority. Under her leadership, IMPA doubled its size and exposed hundreds of money laundering and terrorism financing cases, leading to the crackdown on major criminal organizations and the seizure of billions of illicit funds. Dr. Wagman is the guest speaker for this module.