Overview

To date, financial institutions have paid $320 billion in regulatory fines. With change as the only constant, global regulations are continuallyshiftingand the digital revolution can either be a threat or a survival strategy for companies.The question is, who will survive it? For instance, companies that will succeed are those that comply with the increasingly complex regulations.

According to a recent study fromPonemonandGlobalcapereport, non-compliance costs are 2.71 times more thanthe cost of maintaining or meeting compliance requirements. Specifically, when organisations fail to meet compliance regulations, theywill have to bear costs such astosses, fines, penalties and business disruption.RegTechsolutions provide a more efficient way for organisations to control the cost and complexity of regulatory work, allowing them to stay ahead and gain a competitive advantage.

We have an exciting line-up with pitches from prominentstartupsand a fireside chat to follow. Join our event to expandyour knowledge in theRegTechecosystem and learn more aboutRegTechapplication.Getinsights onthe benefits and challenges organisations face in the digital age!

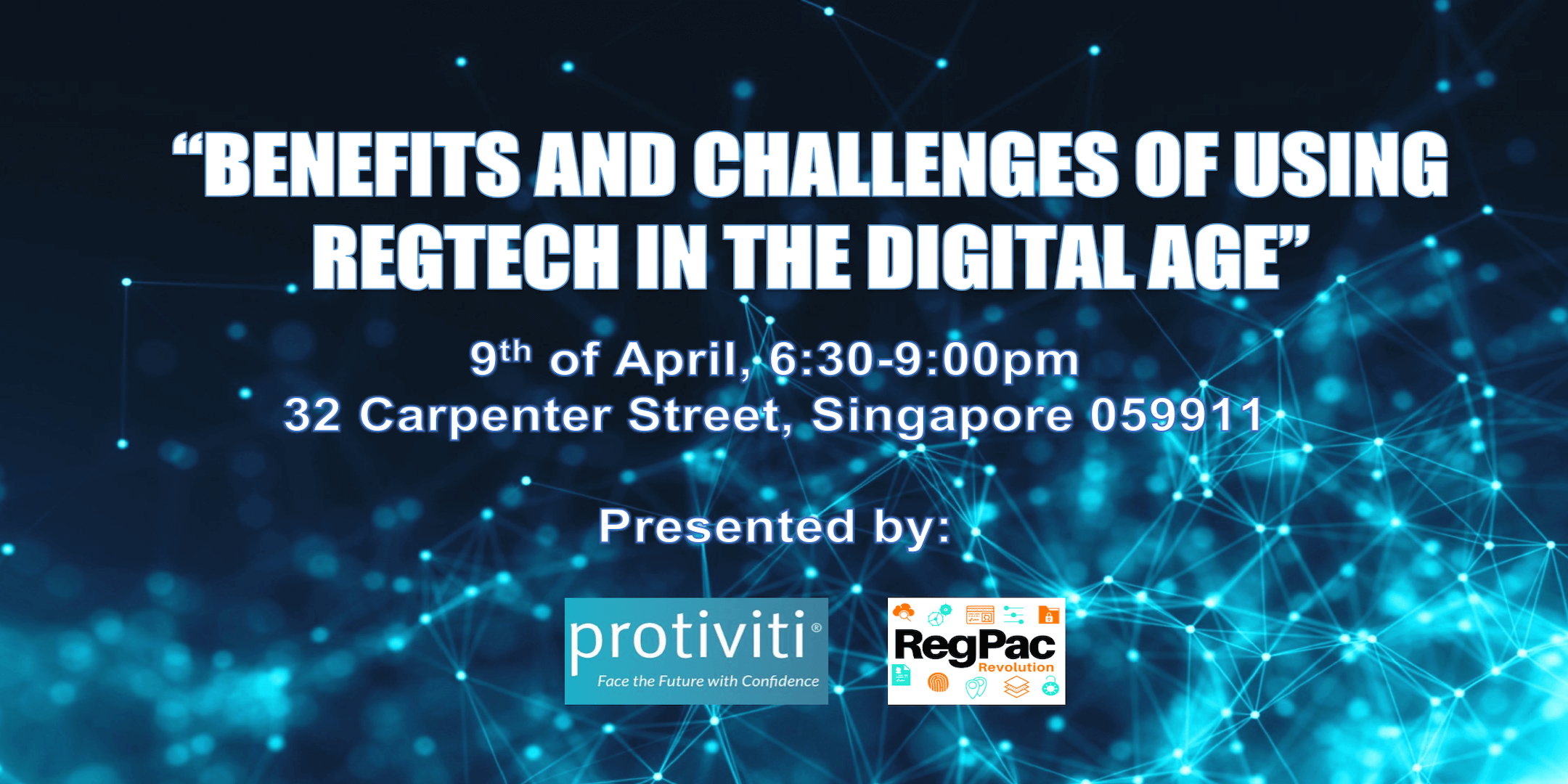

Date: 9 April2019

Time: 6:30pm-9:00pm

Venue: 32 Carpenter Street, Singapore 059911

Speakers:

- CarolBeaumier, Senior Managing Director, Protiviti

- Julien Condamines, Chief Business Officer ofStartup-OCorporate Innovation, Founder & Managing Director of Co-Creation Lab, Entrepreneur-in-Residence at the French Embassy

- VishalRanjane, Managing Director, Protiviti

- NigelRobinson, Managing Director&Country Market Leader(Singapore), Protiviti

Moderator:

- Mona Zoet, Founder & CEO,RegPacRevolution

Programme Details:

6:30pm 6:50pm:Welcome Speech

6:50pm 7:10pm:Keynote Presentation by Protiviti

7:10pm 7:25pm:Fireside Chat

7:25pm 8:15pm:Start-up Pitch Competition

8:15pm 8:20pm:Announcement of Winner of Start-up Pitch Competition

8:20pm 9:00pm:Networking & Canapes

Speakers'Profiles:

CarolBeaumier, Senior Managing Director, Protiviti

Carol is a Senior Managing Director in the firm's Risk and Compliance practice and oversees the firm's Asia-Pac Financial Services Practice. She is a member of the Risk and Compliance practice, an experienced consultant with more than 30 years of experience, and has extensive experience with numerous regulatory issues that affect multiple industries. She has assisted numerous financial institutions with Anti-Money Laundering (AML) related regulatory remediation, including but not limited to, redesigning risk assessment methodologies and Know Your Customer (KYC) standards, revamping policies and procedures, enhancing transaction monitoring, and improving management reporting.

Prior to joining Protiviti, Carol was a Partner with Arthur Andersen where she led the Global Regulatory Practice; a founding member of The Secura Group and leader of the firm's Risk Management practice; and a regulator with the Office of the Comptroller of the Currency, a bureau of the U.S. Treasury Department. Carol is also a frequent author and speaker on regulatory and other risk issues and has made presentations in the United States, United Kingdom, Mexico, Brazil, Hong Kong, and Australia.

Julien Condamines, Chief Business Officer ofStartup-OCorporate Innovation, Founder & Managing Director of Co-Creation Lab, Entrepreneur-in-Residence at the French Embassy

French Globetrotter, ex-Google and Startup-erwith 10 years of practice in Design Thinking, Julien is the Founder of the Co-Creation Lab and Chief Business Officer for Startup-O CorporateInnovation, both supporting largeorganisationsto reinvent themselves from within, promoting intrapreneurship and creative leadership, and through open innovation programs. Hehas worked with some of the top names across industries, including Google, Sanofi, Experian,CrossKnowledge, UPS, Santander, etc.

Julien is one of the leaders for the French Tech community in Singapore, and acts as a techandinnovation consultant for the French Government,for which he led the France-Singapore Yearof Innovationin 2018. Heis also a mentor for early stage impact-driven startups and promotes tech for good initiatives in Singapore. Julien has lived insixcountries acrossfourcontinents and worked with highly multicultural teams, building an expertise in co-creating with teamsof very different backgrounds. He also speaksfourlanguages fluently.

VishalRanjane,Managing Director,Protiviti

Vishal is Managing DirectorofProtiviti in the firm's Risk and Compliance consulting practice. He hasmore than20 years of Process Reengineering/Business Transformation experience,predominantly in the areas of Financial Services, Organizational DesignandStrategic Planning. Vishal has advised Executive Management both as an internal employee as well as an external consultant in matters regarding Integrating Business and Technologies while taking a process-centric view.

Prior to joining Protiviti, Vishal was the Group Vice President of Bank-wide Transformation at M&T Bank. In this role, he led strategic compliance initiatives, including a transformative AML framework to create new sustainable processes related to the customer experience (KYC),and led amulti-yearTransaction Monitoring Enhancement Initiative. Prior to that, he led the AML Remediation activities at HSBC Bank USA/North America. While at HSBC, Vishal created and led the Project Management Office and associated transformation initiatives that addressed the company's regulatory, resourcing, and process standardization needs working closely with HSBC's Executive Management (C-Suite) and Regulators.

Nigel Robinson, Managing Director & Country Market Leader (Singapore), Protiviti

Nigel is a Managing Director and Country Market Lead for Protiviti in Singapore. He has over 25 yearsofconsulting experience within aBig Four' consultancy and professional services capacity working across Europe, Middle East and Asia. He helps clients envision, plan for and execute large scale transformation change to achieve sustainable business goals and strategies. He is a professional strategic and operations management consultant with experience in large scale strategy, transformation and value driven programmes mainly within the Financial Services sector,includingCore Banking and Payments within the FinTech andRegTechlandscape.

His areas of expertise alsolieswithin Risk, Regulatory & Compliance Strategy, Remediation and Automation as well as digital and customer experience. Nigel has been involved in many major projects throughout his career including the IT Service Management Transformation whereby he developed and supported the approach and implementation planning for the delivery of the IT Transformation programme that created aShared Services' organisation, consolidating multiple IT centres, back office functions and data centres to a single site for a major global insurance company.

Moderator's Profile:

Mona Zoet, Founder & CEO,RegPacRevolution

As the Founder and CEO ofRegPacRevolution, Mona has over 15 years of experience in the Financial Services Industry within the Legal, Risk and Compliance areas,specialisingin Risk Management within the Financial Crime areas(AML and KYC). During her banking years, she became acutely aware of the Regulatory, Operational and Risk Management pain points faced by banks and other Financial Institutions alikeandconcluded that many of the same problems could be eliminated more effectively with the use ofRegTech.

She is an Executive Board Member, Southeast Asia Lead and Singapore Chapter President of the InternationalRegTechAssociation (IRTA) which exists to ease and accelerate the evolution of theRegTechindustry, by facilitating integration, collaboration and innovation of all stakeholders, within the Financial Services sector.