Overview

Decentralised Finance (DeFi) is a financial infrastructure built on blockchain, and it is gaining increasing popularity with almost USD 55 billion deployed into it. Developers build DeFi applications on smart-contract-based platforms. They remove the need for traditional financial intermediaries like banks, insurers, exchanges and asset managers.

Course Description & Learning Outcomes

This course allows participants to understand the inner workings of this exciting FinTech innovation and provide a thorough introduction to DeFi, its opportunities, risks, and insights from industry experts. At the end of the 2-day module, participants will be able to: - Learn about the origins of DeFi - Understand functions of DeFi infrastructure including smart contracts/ decentralised applications, oracles and stablecoins - Develop working knowledge of DeFi primitives, e.g., transactions, fungible and non-fungible tokens, custody, supply adjustment and incentives (staking/ slashing), swaps, collateralised and flash loans - Gain an appreciation of the problems that DeFi solves (inefficiency, limited access, opacity, centralised control, lack of interoperability) - Understand the different DeFi use-cases, e.g., Credit/ Lending, Decentralised Exchanges, Derivatives and Tokenisation - Gain an awareness of DeFi related risks, including smart-contract risk, governance risk, oracle risk, scaling risk, DEX risk and regulatory risk

Recommended Prerequisites

Good to have basic knowledge in blockchain technology but not required.

Pre-course instructions

Registration close date: 18/09/2023

Schedule

Date: 27 Sep 2023, Wednesday

Time: 9:00 AM - 5:00 PM (GMT +8:00) Kuala Lumpur, Singapore

Location: Online

Date: 28 Sep 2023, Thursday

Time: 9:00 AM - 5:00 PM (GMT +8:00) Kuala Lumpur, Singapore

Location: Online

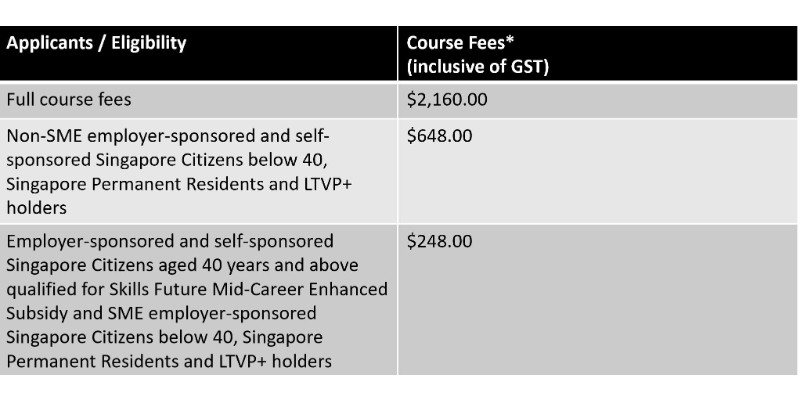

Pricing

Partners