Overview

Providing an essential grounding in the world of Fintech, this module covers the transition from traditional financial services to modern digital solutions, elucidating the symbiotic relationship between the two.

Course Description & Learning Outcomes

It further delves into key concepts such as digital banking, blockchain, payments, robo-advisors, and peer-to-peer lending, discussing their application and impact across different financial domains. The knowledge gained here is not only applicable to retail and consumer finance but extends to business-to-business, industrial, non-profit financial organisations, and the burgeoning sector of Fintech e-commerce. With this solid foundation, participants will be better equipped to understand and navigate the intricate and dynamic world of Fintech in the subsequent modules. This module is part of the Advanced Certificate in Fintech and the Future of Finance. LEARNING OBJECTIVES At the end of the 3-day module, participants will be able to: - Understand the historical development of Fintech and recognise its key milestones - Comprehend the impact of Fintech on traditional financial services and its implications - Gain foundational knowledge on the key concepts within Fintech such as digital banking, payments, blockchain, robo-advisors, and peer-to-peer lending - Recognise emerging trends in Fintech and their potential impact on the future of finance - Engage in discussions to evaluate the real-world implications of Fintech's evolution on the financial industry - Understand the intersection of Fintech and behavioural finance, and how it influences financial decision-making - Gain a comprehensive understanding of how behavioural finance principles are integrated into Fintech applications, including the concept of personalised financial recommendations and nudges

Recommended Prerequisites

- Participants should have a basic understanding of financial and economic concepts. - A basic understanding of technology, including familiarity with computer systems and software applications, is beneficial. - Knowledge of data analysis, programming, or software development, while not mandatory, could enhance the learning experience. - Some professional experience, particularly in roles related to finance, technology, entrepreneurship, or regulation, can enrich the participant's understanding of course content. - Motivated fresh graduates or students with a keen interest in Fintech are also welcome.-

Schedule

End Date: 15 Mar 2024, Friday

Location: Online

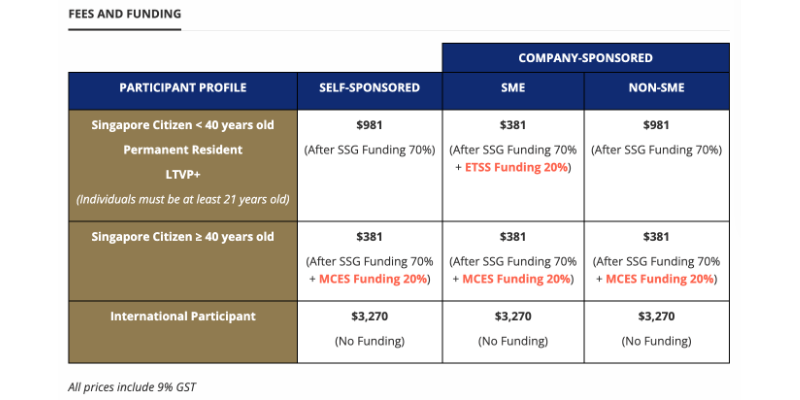

Pricing

Speakers

Trainer's Profile:

Ilan Gildin, Affiliate Faculty, Singapore Management University

Ilan is a highly experienced finance professional and educator, specialising in the increasingly vital field of fintech and digital assets. Currently, he is pursuing a Ph.D. in Finance and holds an MBA with a specialisation in Technology, Innovation, and Entrepreneurship from Tel Aviv University. As the Chief Economist and Strategic Advisor to the Chairman of the Israel Securities Authority (ISA), Gildin heads the economic department, providing crucial economic and empirical support across a range of subjects, including the regulatory framework for digital assets. With his blend of practical experience, academic pursuits, and a keen focus on fintech and digital assets, Gildin provides invaluable perspective to the fintech program. His knowledge and dedication to innovation serve to equip participants with the tools, insights, and understanding required to navigate and thrive in the rapidly evolving world of fintech.