Overview

In the evolving landscape of finance, understanding the broader societal impacts and ethical implications of financial technologies is indispensable.

Course Description & Learning Outcomes

The first part of this module revolves around 'Fintech and Environmental, Social, and Governance (ESG)' where participants delve into the nuances of sustainable finance and how Fintech contributes to this sector. They gain insights into Fintech solutions that drive green financing, impact investing, and sustainable portfolio management. The role of regulatory frameworks in promoting such practices is also examined. The second part is dedicated to understanding the 'Ethical and Social Implications of Fintech'. Participants will learn to comprehend the impact of Fintech on data privacy, financial inclusion, and potential socio-economic disparities. They will explore responsible Fintech practices, understanding how to align financial innovations with ethical considerations. Incorporating lectures, case study analyses, and group discussions, this module ensures participants are adept at identifying the opportunities and challenges associated with Fintech's wider implications. This module is part of the Advanced Certificate in Fintech and the Future of Finance. LEARNING OBJECTIVES At the end of the 3-day module, participants will be able to: - Understand the linkages between Fintech and sustainable finance and grasp how Fintech can contribute to environmental, social, and governance (ESG) objectives - Explore and evaluate specific Fintech solutions that are facilitating green financing, impact investing, and sustainable portfolio management - Examine the role of regulatory frameworks in supporting sustainable finance practices and understand the associated challenges and opportunities - Gain insights into the ethical considerations and social impact of Fintech innovations, including discussions on data privacy, algorithmic bias, and financial inclusion - Evaluate the potential for Fintech to exacerbate or mitigate socio-economic inequalities and understand the role of regulatory and ethical frameworks in ensuring responsible Fintech practices - Engage with case studies to analyse real-world scenarios related to Fintech, ESG considerations, and ethical implications in the industry - Develop critical thinking skills to navigate the evolving landscape of Fintech, ESG, and ethical implications in finance

Recommended Prerequisites

- Participants should have a basic understanding of financial and economic concepts. - A basic understanding of technology, including familiarity with computer systems and software applications, is beneficial. - Knowledge of data analysis, programming, or software development, while not mandatory, could enhance the learning experience. - Some professional experience, particularly in roles related to finance, technology, entrepreneurship, or regulation, can enrich the participant's understanding of course content. - Motivated fresh graduates or students with a keen interest in Fintech are also welcome.-

Schedule

End Date: 16 Aug 2024, Friday

Location: Online

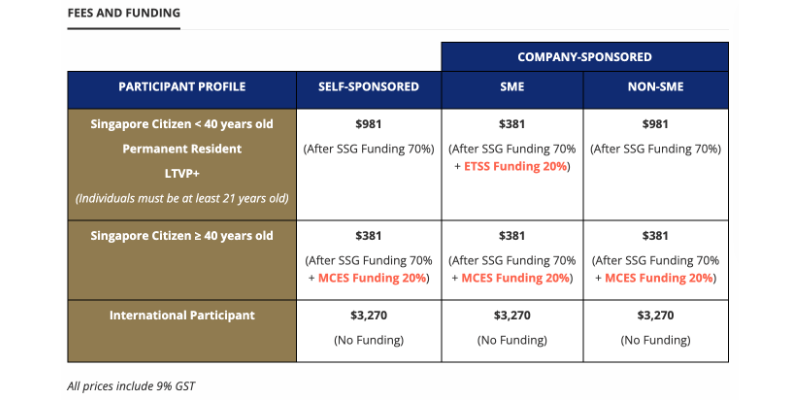

Pricing

Speakers

Trainer's Profile:

Ilan Gildin, SMU Affiliate Faculty, Singapore Management University

As the Chief Economist and Strategic Advisor to the Chairman of the Israel Securities Authority (ISA), Gildin heads the economic department, providing crucial economic and empirical support across a range of subjects, including the regulatory framework for digital assets. With his blend of practical experience, academic pursuits, and a keen focus on fintech and digital assets, Gildin provides invaluable perspective to the fintech program. His knowledge and dedication to innovation serve to equip participants with the tools, insights, and understanding required to navigate and thrive in the rapidly evolving world of fintech. Ilan is the main trainer for this module.

Trainer's Profile:

Arjun Vir Singh, Partner & Global Co-Head of Fintech, Arthur D. Little's Financial Services Practice

Arjun is Partner & Global Co-Head of Fintech with Arthur D. Little's Financial Services Practice. His areas of focus include Fintech, Payments, Digital Assets, Embedded Finance, Application of Emerging Technologies and Emergence of New Business Models within the Financial Services Sector in the MEA region and beyond. He is actively involved across the Tech Start-Up ecosystem - as a passive investor, an advisory board members and as a commentator on the rapidly evolving scene. He was previously the Executive Vice President - Cards and Payments at the Al-Futtaim Group Company (one of the largest UAE HQ conglomerate), where he lead the Payments and Fintech solutions and innovation organization across the Group’s core markets in MEA and APAC. Arjun is the guest speaker for this module.