Overview

90% of the value from S&P 500 are driven by intangible assets in 2020 as compared to 17% back in 1975. The rise of startups and incorporation of technology solutions into enterprises offering further propel this trend. This course offers participants practical knowledge of how IP valuation is derived and the implications and impact behind the value derived.

Course Description & Learning Outcomes

Participants will be equipped with the necessary skill sets to better position their IP and strengthen their negotiation with the intended stakeholders. LEARNING OBJECTIVES • Understand the basic concept of IP and the considerations behind the valuations attached to it • Identify the appropriate valuation methodology behind each IP at its given circumstances and objectives behind the valuation • Understand the narrative behind each valuation and be in a better position to articulate that value to various audiences for whom the valuation is designed • Better position their IP and strengthen their negotiation with investors, collaboration partners and stakeholders alike ASSESSMENT As part of the requirement for SkillsFuture Singapore, there will be an assessment conducted at the end of the course.

Schedule

Date: 16 Jan 2024, Tuesday

Time: 12:00 AM - 5:17 PM (GMT +8:00) Kuala Lumpur, Singapore

Location: Online

Agenda

| Day/Time | Agenda Activity/Description |

|---|---|

| 9am to 5.30pm | IP Valuation |

Pricing

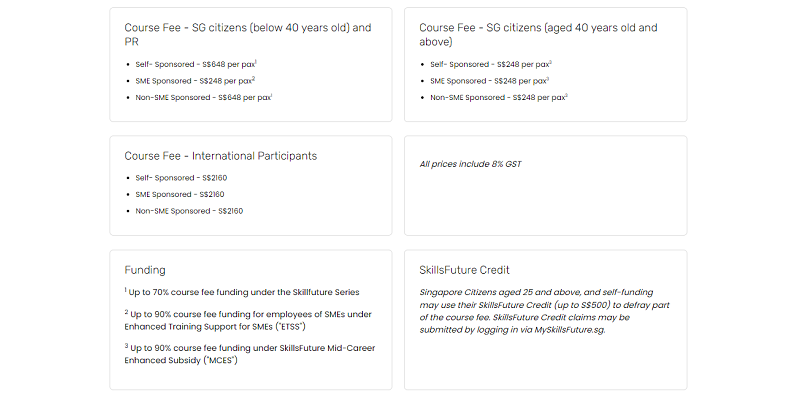

Course fees: SGD2160.00 incl. GST As low as SGD248.00 incl. GST (for Singapore Citizens/ PRs) after maximum funding

Speakers

Trainer's Profile:

Tyler Capson, Managing Director, EverEdge

Tyler is a Managing Director at EverEdge, a global intangible asset advisory, corporate finance, and investment firm. He also heads up the company’s finance and operations functions. Over the last several years, Tyler helped establish the company’s Singapore office and its alliance with IPOS International, a subsidiary of the Intellectual Property Office of Singapore, before recently moving to the United States to continue building EverEdge’s North American footprint. Prior to joining EverEdge, Tyler worked in New York City for Deloitte and Goldman Sachs, advising Wall Street banks and financial institutions, along with working on a number of high-profile transactions including the Facebook IPO and the Apple Bond Offering. Tyler is a Certified Patent Valuation Analyst (CPVA) and Chartered Valuer and Appraiser (CVA). He also holds an MBA from the University of Utah.

Partners