Overview

In 2020, intangible assets accounted for 90% of the value in the S&P 500, a significant increase from just 17% in 1975. This dramatic shift underscores the growing importance of intellectual property (IP), technology, and sustainability in the modern economy. As startups continue to emerge and enterprises increasingly integrate technology solutions, the need to understand and value intangible assets has never been more critical.

This two-day course delves into the nuanced world of intangible asset valuation, emphasizing the role of sustainability in creating long-term value. Participants will gain practical knowledge on how to accurately value IP and other intangible assets, understanding the implications and impact of these valuations. The course covers the intersection of sustainability and IP valuation, highlighting how sustainable practices contribute to the overall value of intangible assets.

Through this course, participants will acquire essential skills to effectively position their IP and sustainability initiatives, enhancing their negotiation capabilities with stakeholders. By focusing on strategies for maximising long-term value, attendees will learn how to leverage intangible assets and sustainability as key drivers of business success in the contemporary landscape.

Who Should Attend

Investors, Bankers, Startups Founders and Executives, Enterprise’s Owners, Investor Relations Executives, Researchers, Public Servants, Legal Advisors, Consultants and Tech-Transfer Officer

Course Description & Learning Outcomes

Overview of IP

Overview of IP valuation

Overview of IP valuation approaches

Evaluation of IP valuation approaches

Challenges faced in IP valuation

Role of IP in long-term value creation

Schedule

End Date: 24 May 2024, Friday

09:00 am - 05:30 pm

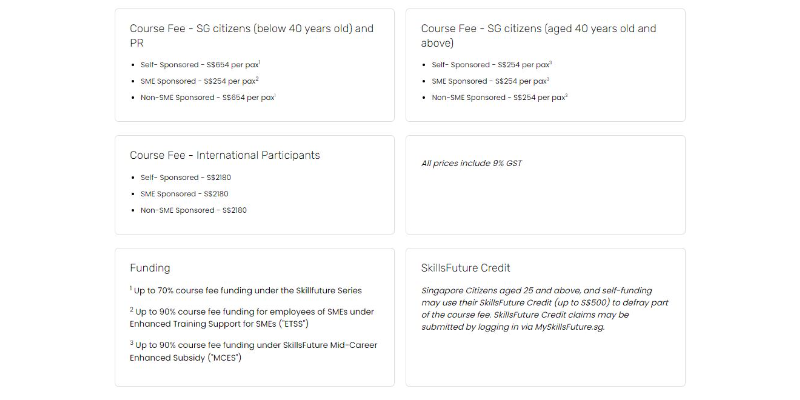

Location: OnlinePricing

Speakers

Trainer's Profile:

Tyler Capson, Managing Director, EverEdge

Tyler is a Managing Director at EverEdge, a global intangible asset advisory, corporate finance, and investment firm. He also heads up the company’s finance and operations functions. Over the last several years, Tyler helped establish the company’s Singapore office and its alliance with IPOS International, a subsidiary of the Intellectual Property Office of Singapore, before recently moving to the United States to continue building EverEdge’s North American footprint. Prior to joining EverEdge, Tyler worked in New York City for Deloitte and Goldman Sachs, advising Wall Street banks and financial institutions, along with working on a number of high-profile transactions including the Facebook IPO and the Apple Bond Offering. Tyler is a Certified Patent Valuation Analyst (CPVA) and Chartered Valuer and Appraiser (CVA). He also holds an MBA from the University of Utah.

Partners