Identifying Deep Tech

Mon, 09/09/2019 - 12:00

What is Deep Tech?

Think Deep Tech as the PhD holders’ startup club where these scientists and engineers with PhDs and advanced degrees are solving large problems facing the world such as global warming, fighting cancers and traffic congestions.

No Angry Birds. No video gaming, messaging apps or media portals.

Deep Tech can also be seen through the lens of Industry 4.0, where we are seeing rapid advances in technologies that are physical (autonomous vehicles, new materials, 3D printing, advanced robotics) or biological (genetic engineering, neurotechnology, bioprinting).

Deep Tech as a phrase has entered the startup lexicon. It was first coined in 2014 by investor Swati Chaturvedi of VC firm Propel(x). She wanted to differentiate the Deep Tech firms from the mass of general tech startups engaged in Internet, mobile and e-commerce work that are based on business model innovation, incremental service improvements or the deployment of standardised technologies.

A quick background on how Deep Tech startups are floated up to investors. VCs and seasoned investors work with a dealflow which is a pipeline of potential startups. This pipeline is filled by their global VC/investor networks as well as various scientific communities such as universities, research institutions and innovation centres. VCs and investors sieve through them to identify the ones that fit their investment focus and who are at a suitable development or commercialisation stage.

Once a VC or an investor is close to a funding decision, then the investment team will meet the entrepreneurs and scientific talent behind the startup for a final assessment and to address specific areas. Such companies are generally located in one of the Deep Tech centres such as Boston (medtech) and Silicon Valley (artificial intelligence).

Deep Tech VS General Tech

General tech startups began in a big way with the arrival of the Internet in the 1990s. It is usually sparked off by an idea to disrupt a traditional business process. They are usually business-to-consumer (B2C) offerings. The strategy is to grow rapidly by raising funds to acquire as many customers as possible, and at the same time try to generate revenue. Few survive this growth journey. Some hang on, kept alive by venture funds instead of fading and dying quickly.

Funding can be as low as US$10,000. Follow-on funding can sometimes be as high as US$1 billion if the objective like super app Grab is to acquire customers quickly in as many countries as possible.

On the other hand, a Deep Tech company starts with a technology, usually based on an innovation or discovery in the lab by doctoral students and research scientists.

The combination of technology and scientific talent forms the backbone of the startup. They are in fields like the life sciences, medical technology, clean technology, renewable energy, autonomous technology and other specific domains.

Commercialising Deep Tech products requires many years. Research takes years before a discovery emerges. Translating the research into products is time consuming because the discovery has never been seen before and must be tested for safe use. Tests especially clinical trials involving people require a few rounds and are tedious to organise. Regulatory approval if needed, must be submitted to individual governments.

Larger funding is required since labs and equipment are expensive. So are research talent. Funding can start small as low as US$1 million but can escalate to hundreds of millions and billions over the years.

The risk of failure is high for both Deep Tech and general tech startups, the norm is nine out of 10 fail. But investments in general tech are generally lower, so the financial loss is smaller.

Entrepreneurial scientists also lack knowledge on how to frame their effort into something that can be commercialised. Their concept of time to market and completeness of solution, may not be obvious. A Singapore medical doctor who invented a heart monitoring device discovered he had no knowledge on how to found a startup. His learning curve was steep, he had to find out how to incorporate a company, hire staff and raise funds. He persisted but he lost valuable time which could have been used to bring the device quicker to the market.

While young or fresh graduates of general tech startups may face similar challenges, their route to the market is faster. A prototype can be available in the first 12 months and a final product is ready the next year. In contrast, hard core science takes years of research and many more years to turn the discovery into a

market-ready product.

Investment evaluation of Deep Tech startups is hard, especially if the subject matter is life sciences and medical technology. It is not infrequent to find excellent research with an estimated time to market of at least 10 years, which is beyond the lifetime of any fund which commonly has a life span of 10 years.

Moreover, investors and entrepreneurs must have the domain expertise to be able to really understand the impact of the new discovery or innovation in order to gauge risk.

Another difference with general tech startups is the considerable duration needed for commercialisation. Exits for Deep Tech investors and entrepreneurs are usually through acquisitions although few are publicly listed. This process frequently takes many more years than general tech startups.

In addition, steeped into academia, entrepreneurial scientists have little corporate and managerial experience. The risk is that they require handholding which is time consuming, a practice unfavoured by busy investors.

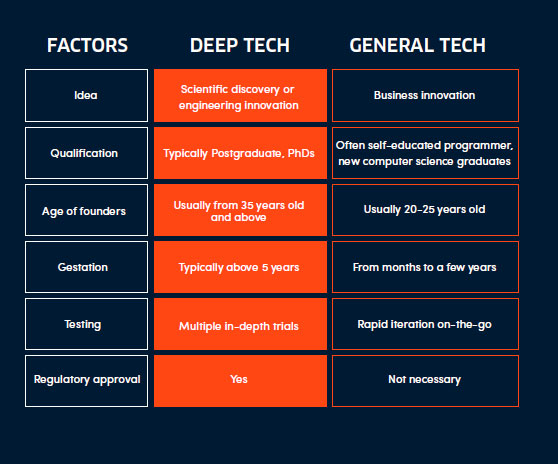

Table summary of the factors that differentiate Deep Tech and General Tech

In the Deep Tech Investments: Realising the Potential Insights Paper, we delve deeper into the Deep Tech landscape, in Singapore and around the world. Download our full report to learn more about how Deep Tech can solve big societal problems in areas such as healthcare and urban mobility, and their potential as an investment asset.

Trending Posts

- Keeping satellites safe: How CYSAT Asia 2026 is tackling space cybersecurity

- The future of fusion energy: What will it take to bring the power of the stars to earth?

- How an aerospace engineer charted a path to quantum technology

- Scaling nanomaterials is challenging — Meet the startup with a hybrid solution

- Surveying Singapore's early-stage emerging tech startup landscape